Equitable and sustainable mining in Bhutan: rhetoric, realities, and recommendations

Executive Summary

The Bhutanese state have the right over its mineral resources. Does state’s coffer get its share? Who does it benefit actually? With Mines and minerals Bill 2020 tabled for parliamentary deliberation and consultative meetings underway, this essay is an attempt to study Bhutan’s mining sector – its contribution to the economy and implications to the society.

Approached from the framework of 5Ws and 1H questions, the article discusses Bhutan’s mineral reserves, legislative instruments, operational apparatus and ground realities. Attempts have also been made to come up with a set of recommendations. State ownership, creation of sovereign wealth fund and investment of mining revenues into capital works are proposed.

Context – where are we?

Mining is one of the Five Jewels. But it is also finite. In an attempt to review existing policy implications and practical shortcomings, ‘the moratorium on new mines and quarries’ was issued on 17 February 2014. Acknowledging policy reconsideration surrounding minerals, an important natural resource of the country, the State Mining Corporation Limited (SMCL) was established on 31 December 2014 by the Executive Order of the Office of the Prime Minister. The Mineral Development Policy 2017 and the draft Mines and Minerals Bill 2020 are indicators of such rethinking.

Amidst these developments, the Department of Geology and Mines (DGM) have floated ‘a notification to apply for lease of mines or quarries’ on 10 September 2019. Against this, the National Council have written to the government to revoke the notification. The Hon’ble Prime Minister clarified that the moratorium is lifted to accept applications. The licences, however, will not be issued. In hindsight, the notification by the DGM was floated after the endorsement of Guideline for Leasing Mines 2019 as an ‘implementation’ tool till Mines and Minerals Bill 2020 is enacted and Mines and Minerals Management Regulations 2002 revised.

Figure 1: Coal mining site at Samdrup Jongkhar. Accessed from http://www.mybhutan.com/explore/samdrup-jongkhar/coal-mining

Reality – what do we know?

Mineral deposits such as dolomite, limestone, coal, slate, quartzite, granite, talc, iron ore and pink shale can be found in southern, western and south-eastern regions of Bhutan. The mineral deposits cannot be inferred as exhaustive list with not more than 40% of the country geologically mapped and prospected as of 2016. There were 24 active mines and 40 quarries in the same year.

Mining started in 1970s as a government enterprise. From 1980s onwards and significantly in 1990s, mines and minerals were privatised. The contribution of mining and quarrying at GDP current prices was Nu.6,954.62 million in 2017. On the employment front, some 1505 Bhutanese were employed between 2008 and 2012. Mines are also said to have benefitted communities through corporate social responsibility (CSR).

That having said, mining sector has come under immense scrutiny as the imposition of moratorium suggests. From lack of financial prudence and tax integrity, administrative lapses to unaccounted social implications, mining sector has gained public interest, unfortunately for undesirable reasons. The Anti-Corruption Commission investigation in 2008 found indiscriminate occurrence of corruption in mining. Between 2008 to 2012, the sector was observed to have undergone fluctuating fortunes with growth rate measuring 20.09% in 2008; -6.9% in 2009; 8.1% in 2010; 24.19% in 2011, -2.24 in 2012. The unstable growth rate suggests two compelling narratives: the volatility of the mining industry and mis-management of the sector or both. Incidentally, “…inadequacies in the legal, institutional and regulatory framework governing the mining sector and weak enforcement and administration of relevant rules and regulations by authorities…” were observed.

Creation of ‘subsidiary company’ and related party transactions are found rampant. Massive gap is reported in remuneration wherein the Chief Executive Officer of a certain company was paid Nu. 500,000.00 a month giving rise to income gap by 3,300% after conducting salary compression ratio. Such differentiation widens the gap between have and have-nots giving rise to wealth concentration and income inequalities. Huge pay checks, particularly for top officials including board directors and inclusion of concessions and personal expenses under company’s expenditure erode profits thus hampering contribution to national economy in the form of tax revenues. An ‘estimated Nu. 670.81 million is found to have lost during the period 2008 to 2012 with an average loss per year amounting to Nu. 134 million.’ It is interesting to note that SMCL only in its second year into operation earned Nu.67.39 million as cumulative profit after tax from its two coal mines in Samdrup Jongkhar in 2017. Mining is a profitable business!

Similar to a generally observed trend, mining in Bhutan is also primarily driven towards economic benefits. Although ‘pre-feasibility study’ and ‘final mine feasibility study’ are expected to ensure community benefits and minimal environment protection, there, however, is dearth of information pertaining to environmental, socio-cultural and health implications other than occasional news and few interview-based reports. Health and well-being concerns, threat to culture such as local beliefs in deities, social issues in migration and abandoned household and economic implication pertaining to effect on agriculture yield were reported. In the case of Khothagpa community, people have complained about dust from mines affecting pollination and fruiting and even attribute dying of fruit trees to mining. The landscape also witnessed major changes as “…a group of some nine households and their farmlands along with pristine forests around some 26 years ago has now been converted into a brown opencast mine site.” Besides this, no empirical study and report pertaining to socio-cultural and environment can be found in relevant official websites. Perhaps, such study has never been carried out?

Economics – who gains? Are there losers?

The SMCL earned a profit of Nu.67.39 million as cumulative profit after tax in just under two years (mid 2016 – 2017). Had private enterprises earned proportionate value of fortunes over the course of time, i.e. from 1990s when the privatisation of minerals began, then it did encourage private sector growth – there was and continues to be a fortune in extracting our mineral deposits. To what extent the benefit reach and who all did it benefit?

The Royal Audit Authority (RAA) established that the state lost Nu.134 million on an average a year between 2008 and 2012. Beyond this, there are other cost as complaints of dust, pollution of water and environment, reduction of agricultural (fruit) yield and landscape change suggest. Because of paucity of information (empirical studies) pertaining to our context, we can infer some of the implications from the studies conducted elsewhere.

Mining brings irreversible changes to ground and surface water, damage of soil profile, and emission of greenhouse gas (GHG) emissions at various stages of mining. For example, ‘in a village in the Czech Republic, around 30% of the coarse particles in the air were traced to the nearby coal mine…’ In India, the Raniganj coalfield in West Bengal, mining activities in Damodar caused the loss of over 5.5 million hectares of farmland. In the Philippines, heightened level of mercury concentrations was noted in some of the river systems up to 15 km from the mining areas. Exposure to coal resultant air pollution is associated with the occurrence of pulmonary and ear, nose and throat problems. These are not exhaustive! Are we doing enough to alleviate the implications brought about by different activities of mining? Probably not. As of today, only two coal mining companies worldwide, Rio Tinto and Vale are reported to have long term targets to reduce GHG emission.

Figure 2: Dolomite mine site, Gomtu. Accessed from https://uk.reuters.com/article/mines-in-bhutan/mines-destroy-bhutans-mountains-idUKHIL52517220070605

Rhetoric – why should it matter?

As much as immediate economic gains, Bhutan’s development efforts are built on the principles and values of long-term sustainability as pronounced in plethora of her legislative instruments. For example, KA 11-1 of the Thrimzhung Chenmo explicitly qualifies the government as the exclusive owner of the minerals. The preamble of the Mines and Minerals Management Act 1995 stipulates ‘the exploitation of resources’ in conformity ‘within the framework of sustainable development and protection of the environment…’ The Economic Development Policy 2016 commits to ensure ‘intergenerational equity’ in terms of ‘access to the use and benefits of natural resources.’

Furthermore, article 1 (12) of the constitution allocates the state the right over its mineral resources. Article 5(1) identifies all Bhutanese as a trustee of the country’s natural resources for the benefit of the present and future generations. Explaining the intent of provision, the Chairman of the Constitution Drafting Committee espouses that while the state is best positioned to conserve these resources, its ownership, however should not ‘favour the few and deny the many.’ Running parallel to it, article 9(7) of the constitution, Principles of State Policy spells out states role in minimising inequalities of income, concentration of wealth, and promote equitable distribution.

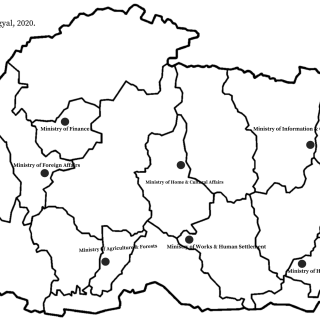

Revisit – when is the right time?

The Guideline for Leasing Mines 2019 bestows the authority to execute mining lease agreement to the DGM. On the other hand, Mineral Development Policy 2017 appropriates the power ‘to lease and regulate all mining related activities to the ‘independent and autonomous’ regulatory body, the Mining Regulatory Authority (MRA). In actuality, the MRA is not yet established because of which the DGM possibly might have adopted the Guideline for Leasing Mines 2019 to give the DGM a legal standing to execute mining lease agreement. If not for the Mineral Development Policy 2017, the Mines and Minerals Management Regulations 2002 gives the Department, the erstwhile Division of Geology of Mines the authority to lease the mines. Such inconsistencies and overlapping clauses across different legal instruments, i.e. guideline, policy and regulation confound general people, at least ordinary people who lack legal education to infer certain legal nuances. Similar to the MDP, the Mines and Minerals Bill 2020 delegates the authority to lease mines to the would be established MRA.

Figure 3: Gypsum mine site, Khothagpa. Accesses from https://thebhutanese.bt/govts-call-on-mining-bill-will-decide-the-fate-of-billions-in-mineral-wealth/

Figure 3: Gypsum mine site, Khothagpa. Accesses from https://thebhutanese.bt/govts-call-on-mining-bill-will-decide-the-fate-of-billions-in-mineral-wealth/

The Mineral Development Policy 2017 categorises minerals into three categories: Strategic Minerals, Industrial Minerals and Construction Materials. Minerals would be qualified as strategic if it has either of the following two characteristics:

- “scarce and essential for domestic industries; or

- rare and high value minerals, and those minerals with

security implication.”

The policy retains the prerogative to allocate all strategic minerals with the government. However, it is found that preceding characteristics of a mineral is not enough to determine whether or not a mineral qualifies as strategic. To determine resource as a scare, it is necessary to know the aggregate/total reserve.

The Mines and Minerals Bill 2020 has provision for establishing a regulatory body in MRA, run by a board. The authority is different from the Department (DGM) both in its roles and composition. Whatever may be the reason, there is no mention about the SMCL in the bill purportedly treating it as any other potential lessee. Nonetheless, the SMCL is a company established with the endorsement of the 45th meeting of the Lhengye Zhungtshog of the second democratically elected government in 2014. What will be the status of the SMCL under the amended act, considering the provisions under the bill?

Guidelines for Leasing Mines 2019 has been adopted. Lease period for some leased mines are reported to have expired, others close to expire. The SMCL despite being a very young, has demonstrated effectiveness and efficiency of a public company if manned diligently. With the Mines and Minerals Bill 2020 tabled for parliamentary deliberation, although ‘VISION 2020’ could not be achieved, perhaps 2020 is the ‘critical juncture’ for us (Bhutan) to set precedent as to how important state resources can be better extracted- equitably and sustainably.

As much as there is general acknowledgement on ensuring ‘intergenerational equity’ of natural resources, apparently, there is no mechanism to ensure such ‘benefit sharing’ across generations. Provisions on ‘community development fund’ (CDF) is also included in the policy but its implementation and benefits, compensation in other words, an affected community received are subject to assessment.

Future – how do we navigate?

‘Paradox of plenty’ which can alternatively be understood through the concept of ‘resource curse’ attempts to explain why natural resource endowed countries, instead of experiencing growth, are trapped in poverty and instability. The proponents of this view cite countries such as Singapore and South Korea with no natural resources base as examples to support a claim that it is system (legal system, economic policies and social context), not natural resources in itself as the driver of growth. However, another school of thought espouses that natural resources indeed facilitate economic growth. Countries such as Botswana, Canada, Chile and Norway are some of the best-known countries in natural resources management. Hence, the convergence of natural resources with that of institutional arrangements can help overcome the perils of ‘resource curse’.

Generally, it has been observed that transparency, accountability with proper reporting mechanism and consultative processes ensure proper management of resources. In Canada, a major net exporter of natural gas and coal, the National Energy Board which oversees offshore drilling reports to the Parliament. In Chile, leading producer of copper, ‘information on both operations and revenues (royalties, taxes, export and production volumes) are published regularly by the Finance Ministry. In addition, the Chilean Commission on Copper and the Mining Ministry publish information on environmental assessments and licensing petitions. The Tswana tribal consultation institution, kgotla in Botswana helped government gain trust of the people in a way that “government exists to serve the people and promote development.” In 2002, the United Nations adopted Berlin II: Guidelines on mining and sustainable development which requires the community to be consulted and encouraged in all issues of mine planning, operation and closure.

Bhutan’s current legislative instruments have provision on Mineral Fiscal Regime covering mineral fiscal instrument, royalty, lease rent and other fees and levies. However, there is no provision that would categorically ensure long-term economic benefits and inter-generational equity. Elsewhere, countries known for prudent management of mineral resources have put in place specific policy intervention. For instance, in Botswana, the largest producer of diamond, fiscal saving, a surplus on the current account of the balance of payments, and investment in infrastructure and human capital helped the country avoid the resource curse. In Norway, the Government Pension Fund Global was set up in 1990 to underpin long-term considerations when petroleum revenues phase out. In addition, 100% of the revenues from oil and petroleum are set aside and 4% of this revenue is channeled for public services. Similarly, in Botswana, the Pula Fund (the oldest and largest sovereign wealth fund in Africa established in 1994, mandates preserving part of the income from diamond exports for future generations.

On the other side of the globe, ‘Nauru with significant phosphate deposits and profitable export gave the country the second highest per capita income in the world in the late 1960s and the 1970s. With phosphate exhausted and revenues gone, the local people are left with a narrow, environmentally precarious rim of land circling a wasteland where the open-pit phosphate mine operated.’ Between 2004 and 2008, Mongolia experienced ‘revenue windfalls’ because of high global minerals prices. The surge in revenue saw increased civil service salary with consequences for inflation. Hadn’t Mongolia passed Fiscal Stability Law, it would have fallen in the trap of the resource curse. In addition, it has established a Human Development Fund targeting more vulnerable segments of the population.

Figure 4: As mother embraces her children, may our laws/policies embrace the needs/interest of all walks of lives. Accessed from http://www.idealtravelcreations.com/bhutan-travel-packages/cultural-tours/happiness-travel/

In Bhutan, the major chunk of domestic revenue goes into meeting the current expenditure. Bhutan’s financial statements as of 30 June 2018 account internal revenue of Nu. 36,871.372 million and the current expenditure of Nu. 27,494.710 million leaving meagre Nu.9,376.662 million for capital works. For example, as the commencement of major revenue generating project such as hydropower draws closer, it would already have been calculated in rising the civil service pay check. Does such initiative ensure equitable distribution of benefits across different walks of lives? Incidentally, pay and allowances constitute major portion ‘accounting for 31.86% of the total current expenditure followed by current grants with 20.92%, then interest payment and travel in-country with 6.85% each.’

Another vital aspect of mines and minerals management is ownership. Debswana Diamond Company (Debswana), the largest producer of diamond in the world by value, based in Botswana is a 50/50 joint venture between the Government of the Republic of Botswana and De Beers Group, a South African company. In Norway, Statoil (now Equinor) was established in 1972 with the Norwegian state as the sole owner. It also required the state to have a 50 per cent ownership interest in every production licence. State ownership of natural resource reserve both in terms of deposits and extraction is found be economically beneficial and its benefits distributive. In Bhutan’s mining industry, SMCL besides 30% corporate income tax, returns its revenue (profit) to the government through Druk Holding & Investments. Meanwhile, private mining companies pay 30% Business Income Tax and the remaining amount is apparently beyond the reach and knowledge of the government.

On the premise of the preceding discussion, following recommendations are seen as economically viable, equitable and sustainable:

- State to have exclusive ownership over the reserve as well as the extraction of minerals. This can be facilitated through existing institution of SMCL or equivalent. In that vein, the status of SMCL needs to be incorporated in the Mines and Minerals Bill 2020;

- Creation of sovereign wealth fund with certain percentage of revenue preserved for future generations to ensure intergenerational equity. In the parallel lines, proportion of revenue also needs to be committed towards environmental and health trust fund for the implications mining have on natural environment and health, respectively; and

- Revenues earned from mines and minerals need to invested in capital/developmental works (through capital expenditure). In addition, specific projects need to be initiated for the benefit of the affected communities.

The mining sector is in the ‘critical juncture‘! Mines and Minerals Bill 2020 is tabled for deliberation. Guidelines of Leasing Mines 2019 has been endorsed. Few leased mines have come to an end of their lease period; some are drawing close to an end. And, state ownership through SMCL have been tried and tested, at least for three years. We have enough experiences to determine a model that would best serve Bhutan equitably and sustainably.

Disclaimer: While I had approached the discussion with certain level of objectivity, I neither claim neutrality nor authority (expert knowledge) on the subject. Opinions expressed are solely of my own.

Bibliography

Ahern, M. & Stephens, C. (2001). Worker and Community Health Impacts Related to Mining Operations Internationally: A Rapid Review of the Literature. Accessed from https://pubs.iied.org/pdfs/G01051.pdf

Anti-Corruption Commission. (2016). Improving Business Environment: The case of the Mining Industry in Bhutan[/ref]Economic Development Policy 2016. Accessed from http://www.moea.gov.bt/wp-content/uploads/2017/07/Economic-Development-Policy-2016.pdf.

Clark, H. (2014). Avoiding the Resource Curse: Managing Extractive Industries for Human Development. Accessed from https://www.undp.org/content/undp/en/home/presscenter/speeches/2011/10/20/helen-clark-avoiding-the-resource-curse-managing-extractive-industries-for-human-development-.html

Department of Public Accounts. (2018). Annual Financial Statements of the Royal Government of Bhutan. Accessed from https://www.mof.gov.bt/wp-content/uploads/2019/05/AFS2017-18English.pdf

Durns, S. (2014). Four Countries that beat the resource curse. Accessed from https://globalriskinsights.com/2014/04/four-countries-that-beat-the-resource-curse/

Galay K. (2008). Socio-economic and Environmental Impact Analysis of Khothagpa Gypsum. Journal of Bhutan Studies, 18, 50-81. http://www.bhutanstudies.org.bt/publicationFiles/JBS/JBS_Vol18/JBS18-2.pdf.

Gapa, A. (2013). Escaping the Resource Curse: The Sources of Institutional Quality in Botswana. Accessed from https://digitalcommons.fiu.edu/etd/1019/. [Former President Festus Mogae stated, “It was agreed between Cabinet and Parliament, that the mineral revenues would be used only for capital projects…” (p.248).

Guideline for Leasing Mines 2019. A copy of the Guideline can be accessed from http://www.moea.gov.bt/wp-content/uploads/2017/07/Guideline-for-Leasing-Mine.pdf.

Lewin, M. (n.d.) Botswana’s success: Good governance, good policies, and good luck. Accessed fromhttp://siteresources.worldbank.org/AFRICAEXT/Resources/258643-1271798012256/Botswana-success.pdf

Mines and Minerals Management Act 1995. Accessed from http://www.moea.gov.bt/wp-content/uploads/2017/07/dgm3.pdf

National Statistics Bureau. (2018). Statistical Yearbook of Bhutan 2018. Thimphu, Bhutan: NSB.

Norway’s Petroleum History. (2019). Accessed from https://www.norskpetroleum.no/en/framework/norways-petroleum-history/

Royal Audit Authority. (2014). Performance Audit Report on Tax on Mining and Quarrying Sector. Accessed from http://www.bhutanaudit.gov.bt/wp-content/uploads/2020/08/Performance_Audit_Report_on_Mining_and_Quarry_2014.pdf

Sloss, L. L. (2017). Environmental and other affects of mining and transport. Accessed from https://www.usea.org/sites/default/files/Environmental%20and%20other%20effects%20of%20mining%20and%20transport%20ccc281.pdf

State Mining Corporation Limited. (2018). Annual Report 2017. Accessed from http://www.smcl.bt/download/SMCL_Inside_21062018.pdf report 2017.

Subha, M. B. (September 14, 2019). Moratorium lifted to accept applications only: PM. Accessed on 18 September 2019 from http://www.kuenselonline.com/moratorium-lifted-to-accept-applications-only-pm/.

Tobgye, S. (n.d.). The Constiution of Bhutan: Principles and Philosophies. Thimphu, Bhutan: Kuensel Corporation Limited.

Nice Dechen…It is such a profound analysis